PROPERTY SEARCH

🏡 Mortgage Loan Options for Florida Buyers (2025 Guide)

Not all homebuyers are the same—and your mortgage shouldn’t be either. Whether you’re buying your first condo in Fort Lauderdale or refinancing your dream home in Weston, there’s a financing program designed to fit your goals, budget, and lifestyle.

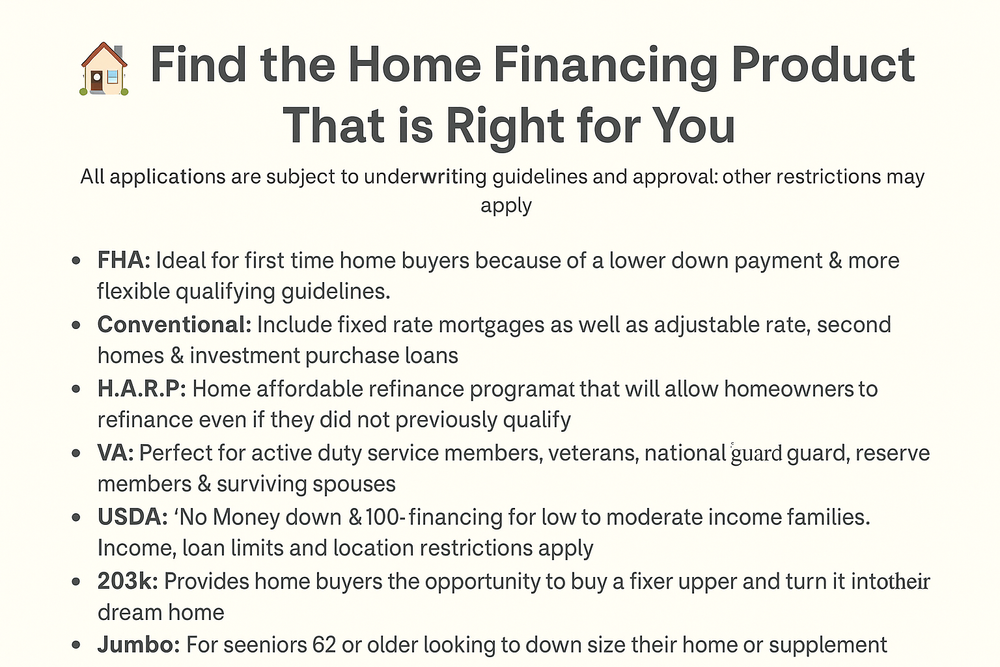

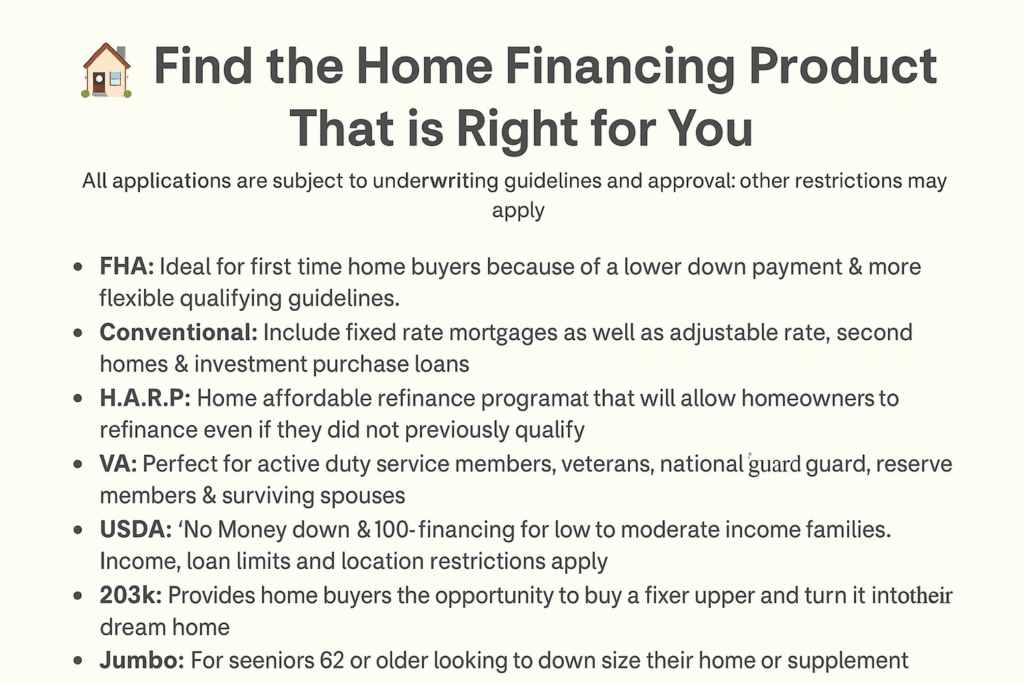

📌 Loan Programs You Should Know

- FHA: Great for first-time buyers with low down payment and flexible credit standards.

- Conventional: Ideal for strong-credit borrowers, investors, or those buying second homes.

- VA: For active duty military, veterans, reservists, and eligible surviving spouses. No down payment required.

- USDA: 100% financing for buyers in rural and select suburban areas. Income limits apply.

- H.A.R.P.: Refinancing option for those who didn’t qualify before. Check eligibility updates.

- 203k: The perfect loan if you want to buy a fixer-upper and finance renovations in one mortgage.

- Reverse Mortgage: For homeowners 62+ looking to downsize or access equity as income.

- Jumbo Loan: Ideal for high-end homebuyers needing financing above $726,200—up to $2M available.

💬 Need Help Choosing?

Our team works with top Florida lenders offering all of these loan programs. Let’s review your scenario and match you with the best option for your situation.

Use our CMA tool to evaluate your current home value or schedule a free consultation to explore your buying power in today’s market.

Also, don’t forget to check out our full library of helpful resources and loan program guides on the Downloads page.

📞 Questions? Reach out anytime at scott@reallistingagent.com or call 954-342-6180.

![There’s No Foreclosure Wave in Sight [INFOGRAPHIC]](https://dannysellsmiamihomes.com/wp-content/uploads/2024/02/Why-Its-More-Affordable-To-Buy-A-Home-This-Year-MEM-rXef5T-344x1024.png)